By Khurram Malik, Senior Director of Product Marketing, Marvell

As AI, cloud computing, and high-performance workloads continue to grow rapidly, data centers are accelerating their infrastructure upgrades. Central to this transformation is the migration to DDR5 memory, designed to meet the increasing demands for bandwidth and speed in servers.

This shift, however, comes with a significant challenge: millions of fully functional DDR4 memory modules, the dominant memory inside today’s servers, could be retired prematurely. This is not because of a performance failure. DDR4 memory modules can operate for a decade or longer. Instead, it is because the latest generation of server CPUs only support DDR5 memory. Put another way, when hyperscalers replace their current servers with DDR5 modules over the coming years, they will be potentially throwing away billions of GBs of fully functional DDR4 memory if they can’t find ways to use them.

The result is a looming e-waste problem and an environmental impact that cannot be ignored. Up to 66 billion kilograms of CO₂ emissions—approximately the same amount that would be generated by 168 billion miles of driving1-- and thousands of tons of e-waste can be avoided by giving DDR4 a second life. Marvell® CXL Structera™ X presents a powerful solution by extending the life of DDR4 memory, enabling data centers to reuse these existing assets, reduce capital expenditures, and minimize their carbon footprint—all while improving the performance footprint of their infrastructure.

Marvell CXL Structera X: A Pathway for More Memory

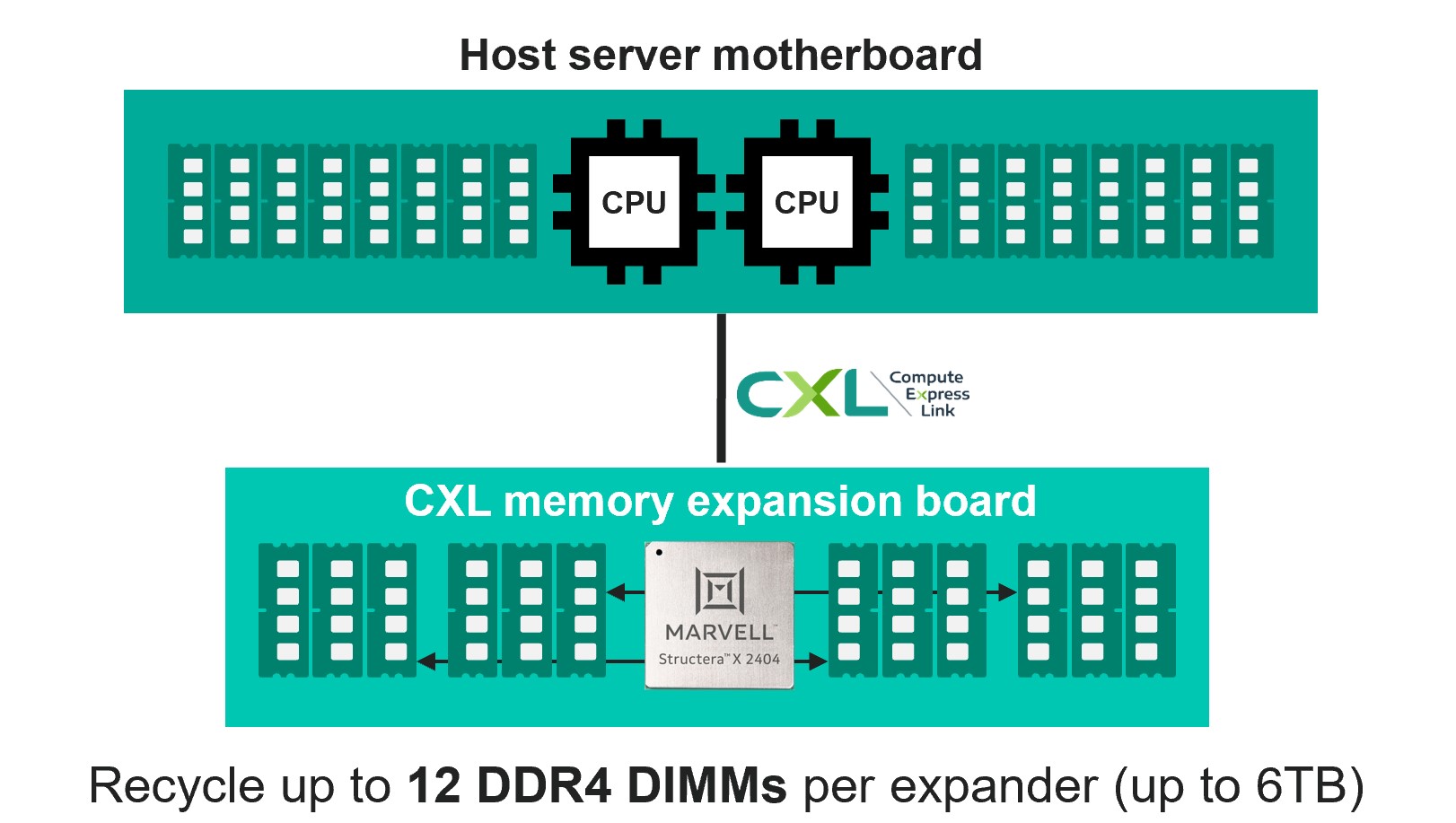

Released last year, Marvell Structera CXL devices effectively allow cloud operators and system designers to add extra memory, memory bandwidth, and/or computing cores to servers by transforming an open PCIe interface into a memory channel. A first-of-its kind device, the Structera A memory accelerator provides a path for adding up to 16 server CPU cores, 200Gb of memory bandwidth and 4TB of memory for offloading the processing of deep learning recommendation models (DLRM) and other tasks for CPUs.

Structera X, meanwhile, focuses on maximizing capacity. A single Structera X 2404 is capable of supporting up to 12 DDR4 additional DIMMs, or 6TB memory capacity without compression, or up to 12TB with LZ4 inline compression in a single one- or two-processor server. It is also the first CXL device to be compatible with both DDR4 or DDR5. As a result, Structera X becomes a conduit for recycling DDR4. The diagram shows more:

Financially, reusing memory is a boon. July 2025 spot prices for 96GB DIMMs of DDR5 memory range from $458 to $488.2 Repurposing TBs of otherwise-to-be-discarded DDR4 instead of buying new DDR5 means thousands of dollars saved per CXL-enhanced server.

By Michael Kanellos, Head of Influencer Relations, Marvell

The opportunity for custom silicon isn’t just getting larger – it’s becoming more diverse.

At the Custom AI Investor Event, Marvell executives outlined how the push to advance accelerated infrastructure is driving surging demand for custom silicon – reshaping the customer base, product categories and underlying technologies. (Here is a link to the recording and presentation slides.)

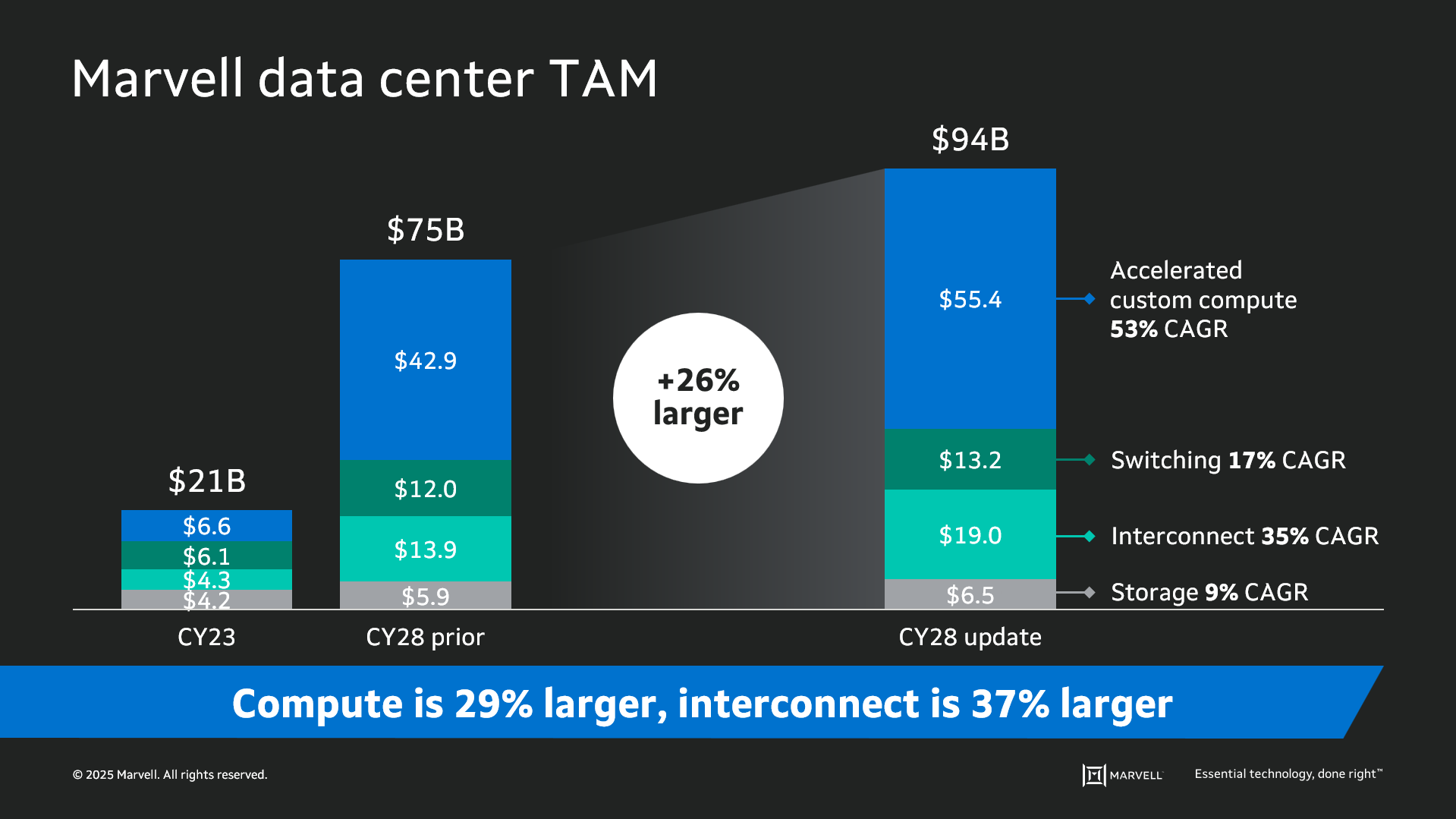

Data infrastructure spending is now slated to surpass $1 trillion by 20281 with the Marvell total addressable market (TAM) for data center semiconductors rising to $94 billion by then, 26% larger than the year before. Of that total, $55.4 billion revolves around custom devices for accelerated compute1. In fact, the forecast for every major product segment has risen in the past year, underscoring the growing momentum behind custom silicon.

The deeper you go into the numbers, the more compelling the story becomes. The custom market is evolving into two distinct elements: the XPU segment, focused on optimized CPUs and accelerators, and the XPU attach segment that includes PCIe retimers, co-processors, CPO components, CXL controllers and other devices that serve to increase the utilization and performance of the entire system. Meanwhile, the TAM for custom XPUs is expected to reach $40.8 billion by 2028, growing at a 47% CAGR1.

Copyright © 2025 Marvell, All rights reserved.